This blog addresses questions about how much, what, and where Bosnia and Herzegovina exports, as well as identifying promising export markets for key export products in the future. It also emphasizes the need to further improve the competitiveness of export-oriented companies, focusing on strengthening the marketing function to explore, analyze, and expand the range of export markets. Additionally, it discusses the importance of producing demanded products and building brands.

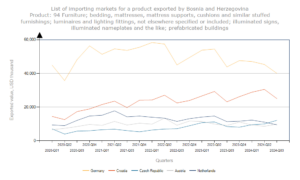

Analyzing data on furniture and wood product exports from Bosnia and Herzegovina, it is evident that exports grew steadily from 2000 until early 2022, after which they began to decline (possibly influenced by the conflict in Ukraine).

In the third quarter of 2024, furniture and related product exports [1] from Bosnia and Herzegovina were 24% lower compared to the first quarter of 2022, when exports of this product group peaked. Similarly, exports of wood and wood products [2] in the third quarter of 2024 were 33% lower compared to the second quarter of 2022, the peak export period for this group of products.

During the first three quarters of 2024, the top export items were: upholstered seats with wooden frames ($88.2 million or 10%), spruce and fir sawn lengthwise, thickness over 6 mm ($74 million or 9%), parts of seats, not of wood ($69.8 million or 8%), wooden furniture ($69.1 million or 8%), etc.

Looking at exports of furniture and related products (group 94) from Bosnia and Herzegovina, Germany is the largest export market, followed by Croatia, the Czech Republic, Austria, and the Netherlands. Exports to Germany have shown a significant decline (especially since early 2022), while exports to Croatia have increased.

Regarding exports of wood and wood products (group 44), the largest export markets are Croatia, Germany, and Italy, followed by Slovenia and Austria to a lesser extent. (Area Nes is used to denote a group of countries unknown to the reporting country).

Export Potential Map

The previous charts show the value of realized exports by country over time. However, which countries could be attractive for future exports? The International Trade Centre’s Export Potential Map model offers insights.

The model predicts the expected trade value between two countries, considering the exporter’s supply capabilities, demand for a specific product, and the relative strength of trade relations between the exporter and importer. It generates a reference value based on historical trade data and projected market access.

Supply and demand analysis is based on trade flows over five years, using weighted averages to mitigate the impact of outliers. Projections are made based on GDP and population forecasts for six years ahead, relative to the most recent year analyzed.

While the model provides valuable guidance, it does not represent the upper limit of export success. Exporters can exceed expected values by achieving exceptional results in some markets, for example, by creating high-quality, branded products tailored to consumer preferences. Unrealized export potential indicates room for growth if barriers such as regulations or mismatches between buyers and sellers can be overcome.

Let’s examine the most attractive countries for exporting key products in the future:

- Upholstered seats with wooden frames (tariff code 940161),

- Spruce and fir sawn lengthwise, thickness over 6 mm (tariff code 440712),

- Wooden furniture (tariff code 940360).

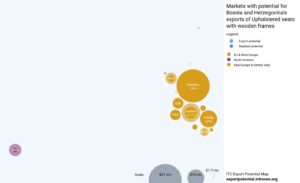

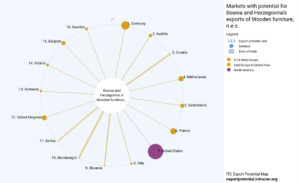

Markets with the greatest potential for export of upholstered seats with wooden frames

The markets with the highest potential for exporting upholstered seats with wooden frames (tariff code 940161) are Germany, Austria, and Croatia.

Austria shows the largest absolute gap between potential and actual exports, offering an opportunity to realize additional exports worth $9.1 million. Following Austria are the USA ($7.7 million unrealized potential), the Netherlands ($5 million), and Montenegro ($4.1 million).

Among the top 15 countries, trade with Montenegro is the easiest (thickest line on the chart), while the USA has the highest demand (largest circle on the chart).

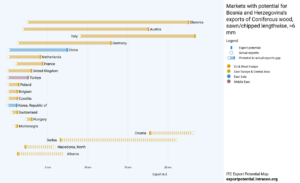

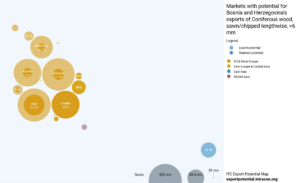

Markets with the greatest potential for export of spruce and fir wood

The markets with the highest potential for exporting spruce and fir wood processed longitudinally, thickness over 6 mm (tariff code 440712), are Italy, Slovenia, and Croatia.

Slovenia shows the largest absolute gap, with unrealized export potential worth $20 million. Austria follows with $15 million, Italy with $14 million, and Germany with $11 million.

Trade is easiest (thickest line on the chart) with regional countries such as Croatia, Serbia, and Slovenia, while the highest demand (largest circle on the chart) is in China.

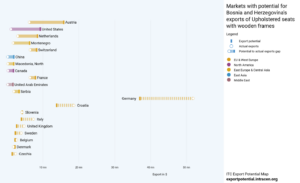

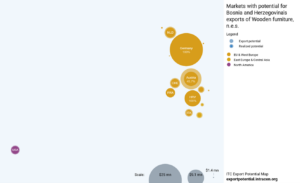

Markets with the greatest potential for export of wooden furniture

The markets with the highest potential for exporting wooden furniture (tariff code 940360) are Germany, Austria, and Croatia.

Austria shows the largest absolute gap between potential and actual exports, with an additional $6.8 million worth of export potential. Following Austria are the Netherlands ($1.8 million unrealized potential), Montenegro, and Switzerland ($1.7 million each).

Trade in wooden furniture is easiest with Montenegro (thickest line on the chart), while the USA has the highest demand (largest circle on the chart).

What does all this tell us?

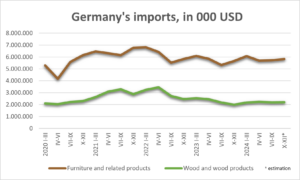

The analysis reveals that Bosnia and Herzegovina’s wood processing industry is predominantly focused on the German market, which is experiencing a decline in imports. Furniture and related product imports into Germany in Q3 2024 were 16% lower compared to Q1 2022, while imports of wood and wood products in Q3 2024 were down by 37% compared to Q2 2022.

However, even under such conditions, some regional countries have maintained or increased their exports to Germany. For example, Serbia has continuously increased furniture exports to Germany since 2020, while Croatia has maintained relatively stable levels, in contrast to the significant decline observed in Bosnia and Herzegovina (and Slovenia).

This highlights the need to enhance the competitiveness of export-oriented companies, focusing on strengthening marketing function to explore and expand export markets, thus reducing dependency on a single or limited number of export markets and the associated risks. The identified export markets in the blog can serve as a starting point for further and more detailed research. However, expanding to new markets should not mean merely finding new buyers for existing products (a characteristic of sales-oriented business orientation); instead, companies should aim to identify, develop, produce, launch, promote and distribute demanded products and build brands. This is a hallmark of the marketing orientation of businesses, where sales occur as a result.

On this challenging path, export-oriented companies should not be left on their own, but supported by domestic institutions, support organizations, and international projects.

Footnotes:

[1] It includes product group 94: Furniture; bedding, mattresses, mattress supports, cushions and similar stuffed furnishings; luminaires and lighting fittings, not elsewhere specified or included; illuminated signs, illuminated nameplates and the like; prefabricated buildings.

[2] It includes product group 44: Wood and articles of wood; wood charcoal